This article will explore these five fundamental steps and help you lay a strong foundation for personal finance. Remember, a personal finance flowchart is a great tool to monitor your financial condition and make wise financial decisions. Continuously investing, even after reaching your financial goals, is essential for financial stability.

The Basics Of Personal Finance

When managing personal finances, follow a flowchart for a systematic approach. Key steps include income, spending, saving, protecting, and investing to reach financial goals effectively. Take control of your finances with this structured process and secure your future financially.

Understanding Personal Finance

A personal finance flowchart is a systematic visual representation of the steps needed to manage your finances effectively. It serves as a guide to help you make informed decisions about your income, spending, saving, protecting, and investing. By understanding the basics of personal finance, you can gain control over your financial situation and work towards your long-term goals.

Importance Of Personal Finance

Personal finance plays a crucial role in achieving financial stability and security. It allows you to:

- Take control of your income and spending, ensuring that you live within your means.

- Protect yourself and your assets by having appropriate insurance coverage.

- Save for emergencies and future goals, such as buying a house or funding your retirement.

- Invest wisely to grow your wealth and achieve financial independence.

By prioritizing personal finance and following a well-defined flowchart, you can make informed decisions and create a solid foundation for a secure financial future.

Credit: www.mdpi.com

Key Areas Of Personal Finance

In the world of personal finance, understanding key areas is crucial to success. One such area is the Personal Finance Flowchart, which outlines steps like income, spending, protecting, saving, and investing, helping individuals take control of their finances and work towards long-term goals.

Income Management

Effective income management is key to achieving financial stability and reaching your long-term goals. It involves not only earning a steady income but also maximizing your earning potential. Here are a few strategies to consider:

- 1. Diversify Your Income Sources: Explore opportunities to earn additional income through side gigs, freelancing, or investments.

- 2. Budgeting: Create a budget to track your income and expenses. This will help you identify areas where you can cut back and save more.

- 3. Increase Skills and Education: Continuously invest in yourself by acquiring new skills and knowledge that can lead to higher-paying job opportunities.

Spending Habits

Your spending habits play a crucial role in your financial well-being. By understanding your priorities and making conscious decisions about how you spend your money, you can control your expenses and avoid unnecessary debt. Here are some ways to improve your spending habits:

- 1. Differentiate Between Needs and Wants: Prioritize your essential needs and limit spending on discretionary items.

- 2. Track Your Expenses: Keep a record of all your expenses to gain visibility into where your money is going. This will help you identify areas where you can cut back.

- 3. Use Cashback and Coupons: Take advantage of cashback offers, discounts, and coupons to save money on your purchases.

Protecting Your Finances

Protecting your finances is vital to safeguarding your hard-earned money and assets. Here are some steps to consider:

- 1. Emergency Fund: Build an emergency fund to cover unexpected expenses and mitigate financial risks.

- 2. Insurance Coverage: Evaluate your insurance needs and ensure you have adequate coverage for health, life, property, and other valuable assets.

- 3. Estate Planning: Plan for the future by creating a will, setting up a trust, and appointing beneficiaries for your assets.

Saving Strategies

Saving is essential for achieving financial stability and meeting your long-term goals. Here are some saving strategies to make the most of your income:

- 1. Pay Yourself First: Prioritize saving by setting aside a portion of your income before paying your bills and expenses.

- 2. Automate Savings: Use automatic transfers to move a certain amount of money into your savings account each month.

- 3. Set Realistic Goals: Define specific saving goals and create a timeline to track your progress.

Investment Practices

Investing is a powerful way to grow your wealth over time. Here are some key investment practices to consider:

- 1. Determine Your Risk Tolerance: Understand your risk tolerance and invest accordingly.

- 2. Diversify Your Portfolio: Spread your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds.

- 3. Stay Informed: Continuously educate yourself about the financial markets and stay updated on investment trends.

Implementing A Personal Finance Flowchart

Creating a Personal Finance Flowchart involves outlining your financial plan visually.

To ensure financial stability, establish priorities like debt repayment and emergency savings.

Stay flexible to adjust your flowchart as circumstances or goals evolve.

Tools And Resources For Personal Finance

When managing personal finances, having access to the right tools and resources is crucial for effective planning and decision-making. Whether it's budgeting templates, online platforms for financial planning, or interactive flowchart examples, utilizing these resources can significantly simplify the process of managing your finances. In this section, we'll explore some essential tools and resources that can empower you to take control of your financial well-being.

Budgeting Templates

Creating and sticking to a budget is a fundamental aspect of personal finance. Budgeting templates provide a structured framework to track income, expenses, and savings, allowing individuals to gain a comprehensive understanding of their financial standing. These templates often include categories for various expenses such as housing, transportation, utilities, groceries, and entertainment, enabling users to allocate their funds efficiently. By leveraging budgeting templates, individuals can gain clarity and control over their spending habits and savings goals.

Online Platforms For Financial Planning

With the advancements in financial technology, there is an abundance of online platforms dedicated to financial planning and management. These platforms offer features such as personalized budgeting tools, investment tracking, retirement planning calculators, and goal setting functionalities. Users can link their bank accounts, credit cards, and investment accounts to these platforms to obtain a holistic view of their finances and receive actionable insights for better decision-making. Leveraging online platforms for financial planning empowers individuals to streamline their financial activities, optimize their investments, and work towards achieving their long-term financial aspirations.

Interactive Flowchart Examples

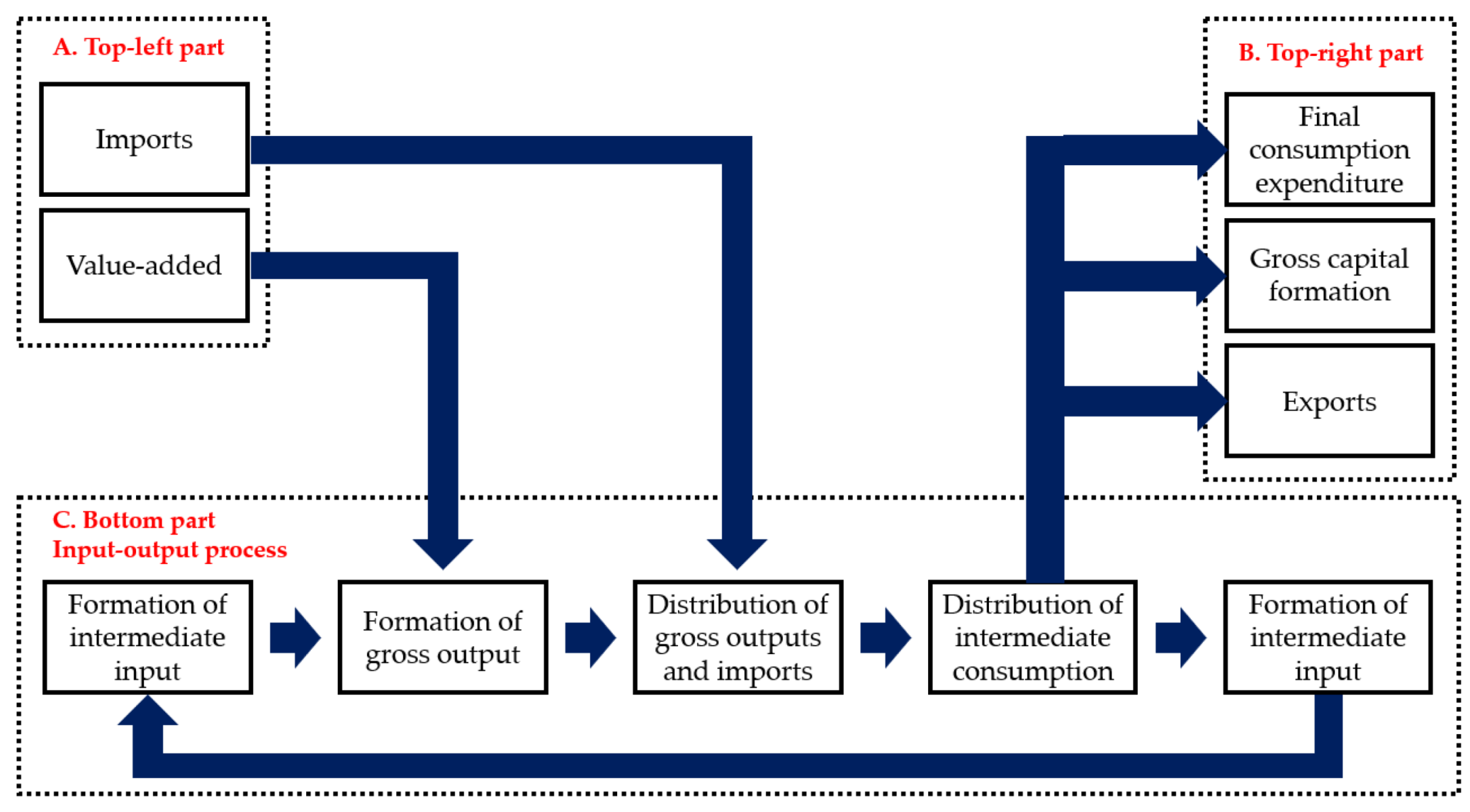

Interactive flowchart examples serve as visual aids to map out various financial scenarios and decision-making processes. These flowcharts often depict the progression of income, allocation of funds for expenses, savings, and investments, as well as potential outcomes based on different choices. By engaging with interactive flowchart examples, individuals can gain a deeper comprehension of the implications of their financial decisions and develop a strategic approach towards their financial goals. With interactive elements and informative visuals, these flowchart examples enhance financial literacy and promote prudent financial management.

Success Stories And Tips

Real-life Applications

Personal finance flowcharts are not just theoretical concepts, but they have been pivotal in transforming the financial lives of many individuals. For instance, Allison, a single mother, successfully implemented a personal finance flowchart to manage her budget and savings effectively. By categorizing her income, prioritizing spending, and regularly monitoring her financial activities, she was able to allocate funds for her child's education and build an emergency fund. Similarly, John, a young professional, utilized a personalized flowchart to streamline his investment strategies, resulting in significant portfolio growth within a short period.

Achieving Financial Independence

Many success stories center around the achievement of financial independence through structured financial planning using a flowchart. Terry, after years of diligent adherence to his financial flowchart, achieved early retirement in his 40s while maintaining a comfortable lifestyle. Sarah, through consistent tracking of her expenses and maximizing her resources, managed to transition to part-time work and pursued her passion as a freelance writer, achieving financial independence and fulfillment.

Maximizing Your Resources

Individuals who have maximized their resources by integrating personal finance flowcharts into their lives have experienced tremendous benefits. From effectively managing debt to systematically building wealth and securing their future, these success stories demonstrate the power of utilizing flowcharts as a financial tool.

Credit: study.com

Credit: onthemoneytrack.com

Frequently Asked Questions On Personal Finance Flowchart

What Are The 5 Stages Of Personal Finance?

The 5 stages of personal finance are income, spending, protecting, saving, and investing. By following these steps, you can take control of your finances and work towards your long-term goals.

What Are The 5 Main Components Of Personal Finance?

The 5 main components of personal finance are income, spending, protecting, saving, and investing. Take control of your finances.

What Is The 50 30 20 Rule?

The 50 30 20 rule is a guideline for budgeting, where 50% of income goes to needs, 30% to wants, and 20% to savings and debt payments.

What Is The 70 30 Rule In Personal Finance?

The 70 30 rule in personal finance suggests allocating 70% of income to living expenses and 30% to savings and discretionary spending.

Conclusion

In wrapping up, mastering personal finance involves steps like managing income, spending wisely, safeguarding funds, saving diligently, and investing strategically. These pillars pave the way towards achieving financial freedom and long-term security. Embrace this approach to take charge of your finances for a brighter future.

0 Comments