From tracking expenses to creating budgets and setting savings goals, personal finance apps offer a range of features to help individuals take control of their financial well-being. With the vast array of options available, finding the right personal finance app can be a game-changer in achieving financial success.

Introduction To Personal Finance Apps

Discover the world of personal finance apps and take control of your finances effortlessly. With a variety of options available, these apps help you track your expenses, manage your budget, and achieve your savings goals. Stay on top of your finances with the convenience of personal finance apps.

What Are Personal Finance Apps?

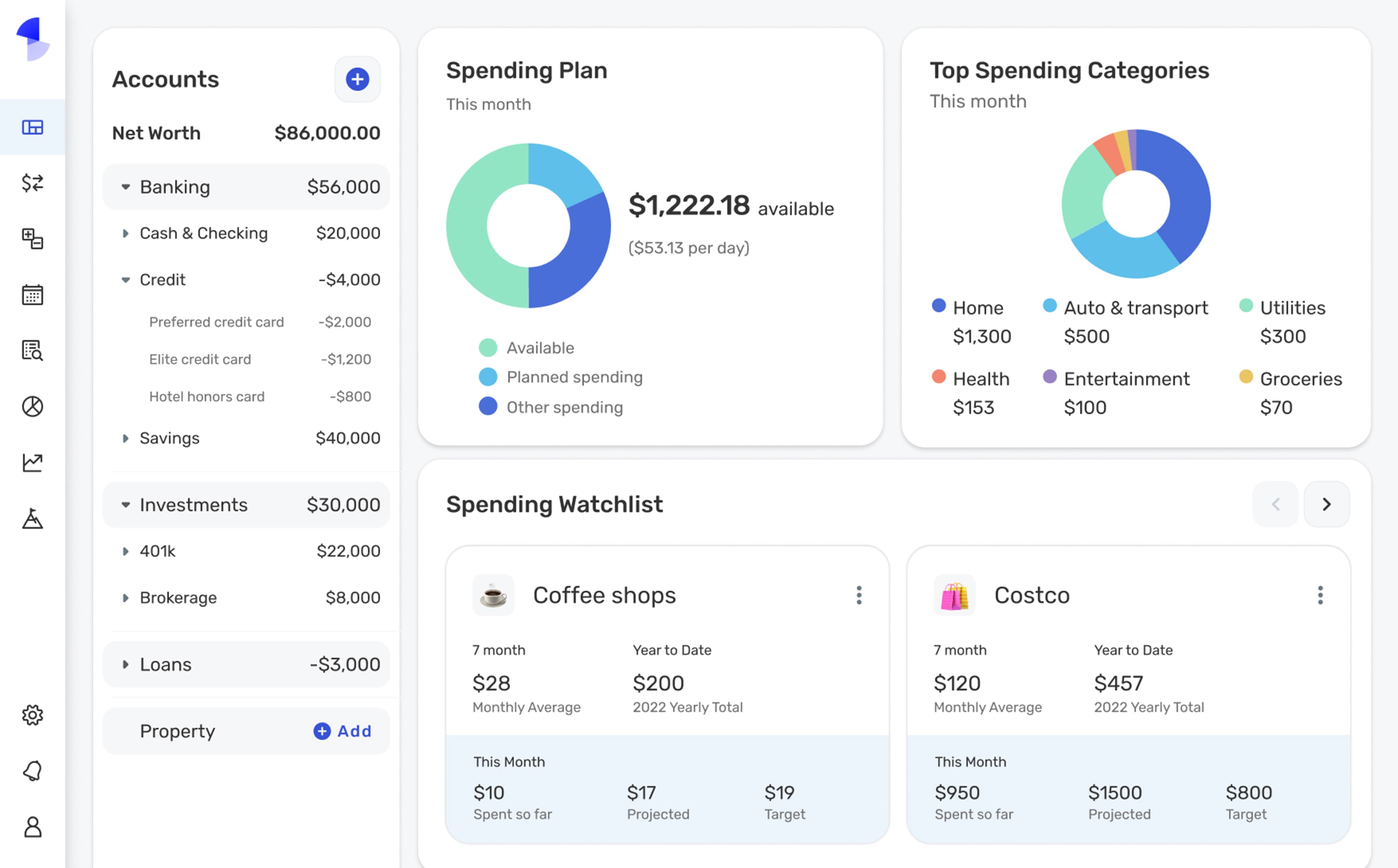

Personal finance apps are tools that you can use on your smartphone or computer to manage your finances. These apps help you track your income, expenses, and savings, and provide valuable insights into your spending habits. With the help of personal finance apps, you can create budgets, set financial goals, and monitor your progress towards achieving them. These apps are designed to simplify the process of managing your money and give you a clear picture of your overall financial health.

Why Are Personal Finance Apps Important?

Personal finance apps are essential in today's fast-paced and digital world. They offer a range of benefits that can improve your financial well-being and help you make informed decisions about your money. Here are some reasons why personal finance apps are important:

- Track your expenses: Personal finance apps allow you to categorize your expenses and track where your money is going. This makes it easier to identify areas where you can cut back and save money.

- Create budgets: These apps enable you to set budgets for different expense categories and track your progress. By having a budget in place, you can avoid overspending and ensure that you allocate enough money towards your savings and financial goals.

- Monitor your savings: Personal finance apps provide a snapshot of your savings progress. You can set savings goals and track how close you are to achieving them. This helps you stay motivated and disciplined in your saving habits.

- Get insights into your spending habits: By analyzing your spending patterns, personal finance apps can provide valuable insights into your financial behavior. You can see where you are overspending, identify trends, and make adjustments to improve your financial situation.

Overall, personal finance apps are powerful tools that can empower you to take control of your finances and make smarter financial decisions. Whether you are looking to save for a big purchase, pay off debt, or simply gain a better understanding of your financial situation, these apps can be a game-changer.

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Credit: www.investopedia.com

Top Features To Look For In A Personal Finance App

Personal finance apps offer a convenient way to manage your money and achieve your financial goals. With a multitude of options available, it's essential to choose an app that aligns with your specific needs. Here are the key features to consider when selecting a personal finance app:

Expense Tracking

Easily track your spending habits by categorizing expenses and monitoring where your money is going.

Budgeting Tools

Set realistic budgets for different categories and receive notifications when you exceed your limits.

Bill Payment

Schedule and automate bill payments to avoid late fees and keep track of your upcoming expenses.

Investment Tracking

Monitor your investment portfolios, track performance, and receive insights to make informed decisions.

Credit Score Monitoring

Stay updated on your credit score, receive alerts for changes, and access tools to improve your credit health.

10 Must-have Personal Finance Apps

If you're looking to take control of your finances, these 10 must-have personal finance apps can help you budget, save, and manage your money effectively. From budget tracking to expense management, these apps offer a wide range of features to suit your specific financial needs.

Mint

Mint is a powerful personal finance app that allows you to track and categorize your expenses, set budget goals, and get personalized tips for saving money.

Ynab (you Need A Budget)

YNAB, also known as You Need a Budget, is a popular app that focuses on zero-based budgeting, helping users assign every dollar a job and stay on top of their finances.

Quicken

Quicken is a comprehensive finance management tool that offers features for budgeting, bill tracking, investment monitoring, and more. It's a great all-in-one solution for individuals and small businesses.

Pocketguard

PocketGuard simplifies budgeting by automatically categorizing and organizing your expenses, helping you stay on top of your spending and saving goals.

Personal Capital

Personal Capital is designed for investment tracking and retirement planning, offering a holistic view of your financial portfolio and helping you make informed investment decisions.

Goodbudget

Goodbudget is based on the envelope budgeting method, allowing users to allocate funds into different categories and manage their spending effectively.

Everydollar

EveryDollar provides a simple zero-based budgeting approach, helping users plan and track their spending with ease and precision.

Honeydue

Honeydue is a free budgeting app designed for couples to manage their personal and shared finances, facilitating transparency and collaboration in financial matters.

Empower

Empower offers comprehensive budgeting and saving features, along with a high-yield checking account and cash advance options to help users improve their financial wellness.

Monarch Money

Monarch Money is a user-friendly budgeting app designed to help individuals track expenses, set savings goals, and make informed financial decisions for a more secure future.

Credit: www.pcmag.com

Choosing The Right Personal Finance App For You

Choosing the right personal finance app can have a significant impact on your financial journey. With the plethora of options available, it’s important to consider several factors before making a decision. From assessing your financial goals to evaluating budgeting styles and comparing features and pricing, finding the perfect app can streamline your financial management and help you achieve your objectives.

Assessing Your Financial Goals

Before delving into personal finance apps, it’s crucial to evaluate your financial goals. Whether you aim to save for a big purchase, pay off debts, or build an emergency fund, knowing your objectives will guide you in selecting an app that aligns with your aspirations. Understanding your priorities and long-term financial targets will streamline your app selection process.

Considering Your Budgeting Style

Every individual has a unique budgeting style, and it’s vital to consider this when choosing a personal finance app. Whether you prefer zero-based budgeting, envelope budgeting, or a more simplified approach, finding an app that complements your budgeting style is essential. This ensures a seamless integration of the app into your financial routine, making it easier to stick to your budgeting strategy.

Comparing Features And Pricing

When evaluating personal finance apps, comparing features and pricing is crucial. Assess whether the app offers comprehensive expense tracking, goal setting, investment tracking, and customization options. Additionally, consider the pricing structure to ensure it aligns with your budget. Analyzing the features and pricing of different apps will help you identify the most suitable option for your financial needs.

Tips For Maximizing The Benefits Of Personal Finance Apps

Maximize the benefits of personal finance apps with these helpful tips. From creating a budget to setting savings goals, these apps can help you take control of your finances.

Set Realistic Goals

Setting realistic financial goals is crucial for effective money management. It helps motivate and guide your spending habits.

Track Your Spending Regularly

Regularly tracking your expenses helps identify patterns and areas for improvement, leading to better financial decisions.

Automate Your Finances

Automation simplifies bill payments and savings contributions, ensuring timely transactions and avoiding late fees.

Use The App's Budgeting Tools

Make full use of the app's built-in budgeting tools to categorize expenses, set limits, and gain insights into spending habits.

Review And Adjust Your Budget Regularly

Regularly review and adjust your budget based on your financial progress and changing priorities to ensure financial stability.

Credit: www.google.com

Frequently Asked Questions On Personal Finance Apps

Is There An App To Organize Finances Free?

Yes, Honeydue is a free budgeting app for managing personal and shared budgets in one place.

What Is The Number 1 Budget App?

The number 1 budget app is "You Need a Budget (YNAB)" for its hands-on zero-based budgeting approach.

What Is The Best App To Keep Track Of Personal Spending?

The best app to keep track of personal spending is PocketGuard. It offers a simple interface showing your available money, bills, and leftover funds. It also provides a customizable pie chart displaying your major expenses, making budget tracking easier.

Is There A Better Option Than Mint?

There are several alternatives to Mint like YNAB, PocketGuard, and Goodbudget that offer different features.

Conclusion

Discover the freedom of financial control with these top personal finance apps. Manage expenses, budgets, and savings effortlessly. Start your journey to financial success today! Whether tracking spending or budgeting, these apps have you covered. Take charge of your finances with the power of technology.

Time to thrive!

0 Comments